Step 1: Setting up and Understanding the Trading Screen

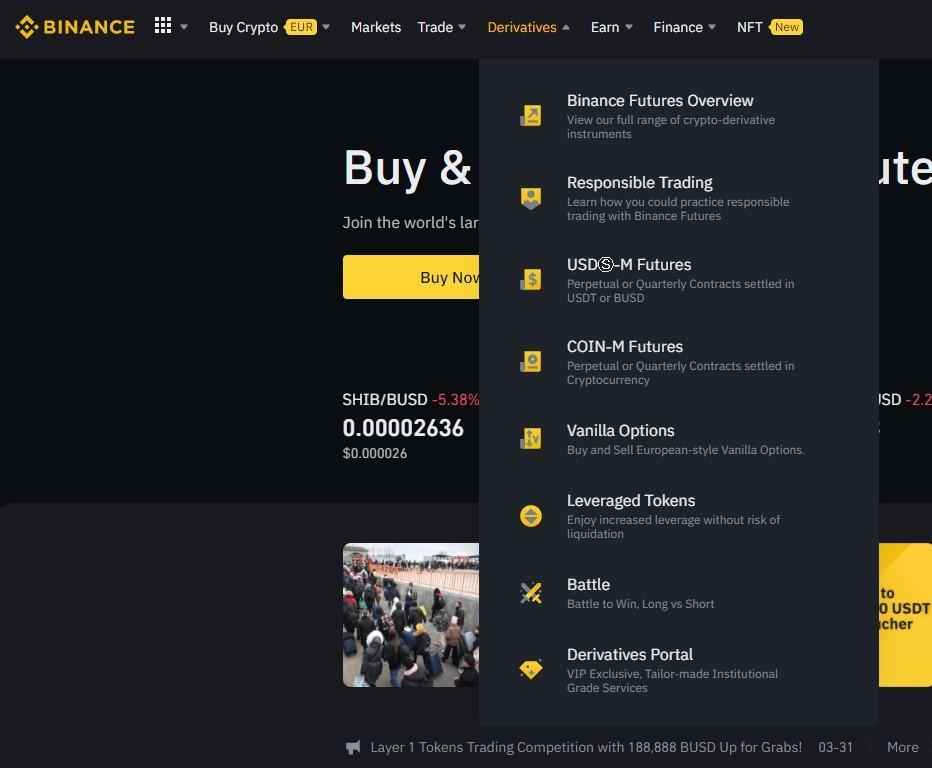

To get started, head over to the main screen on your Binance account. Go to the Derivatives tab at the top and when you hover over it, it will show a dropdown menu.

If you don’t have a Binance account yet, you will have to create one. Remember that Binance is a centralized exchange and would require you to do the KYC to sign up and be able to start trading on the platform. Depending on where you are located, you might/might not be able to join. Please conduct thorough research before signing up.

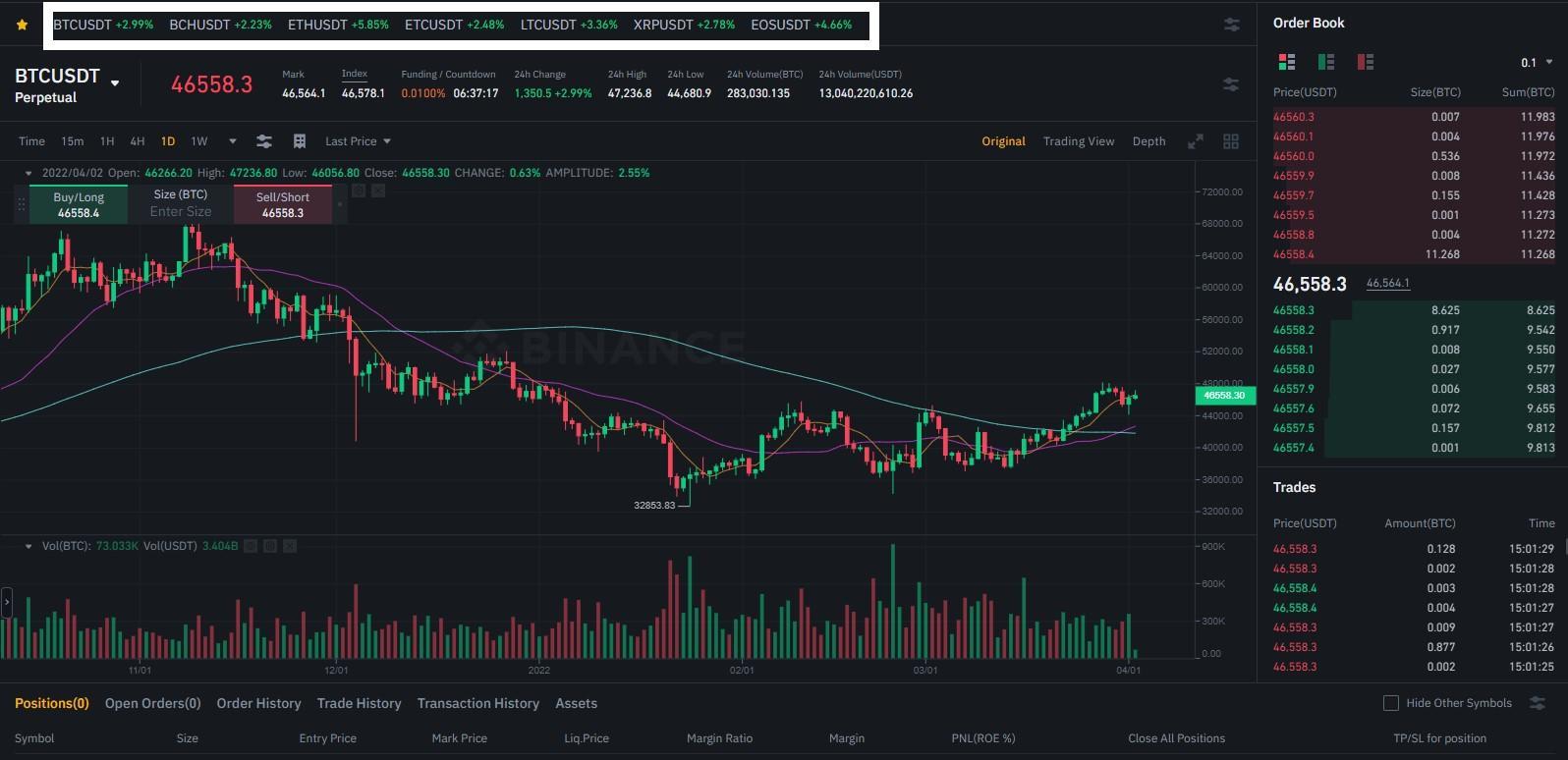

As a next step, when you click on USD-M Futures, you will be redirected to the trading screen which will look like this.

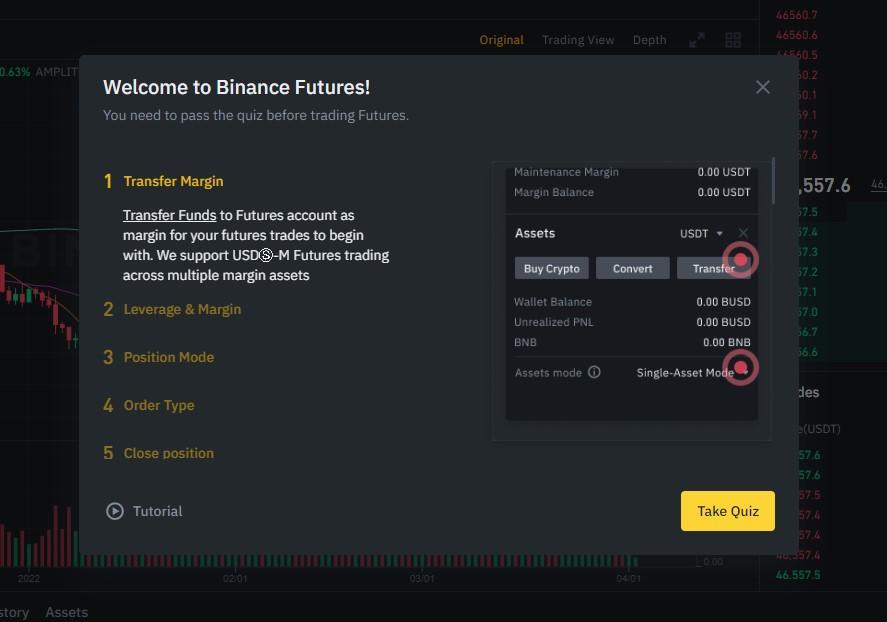

If you are trading Futures for the first time, then you’ll be prompted to open a Futures account with Binance on the right. Going ahead with it, you will be shown these prompts.

You will have to click on “Take Quiz” to be able to start trading futures. There are a total of 14 questions, and it is highly recommended that you take the quiz seriously as it will help you understand the basics of futures trading, especially liquidations and margin. When done, you will be redirected to the trading screen and will now be able to begin trading. It is crucial to understand that trading futures is quite different than trading assets. When you trade an asset, you are essentially swapping two assets. In futures, however, you are trading contracts. These contracts are listed at the top of your trading screens like this.

Just like you would access asset pairs for trading, you will also be able to search for different futures contracts in the drop-down menu. Since futures are derivatives financial instruments, you are not trading the underlying asset itself. That is why, you will see this box which will let you go long and/or short on the futures contract. Traders usually go long when they anticipate an upward price movement in the underlying asset and short when they anticipate a downward price movement in the underlying asset.

When you do access the drop-do

wn menu, you will see that there is a range of futures contracts available - from quarterly to perpetual. As the names suggest, some of these contracts will have a specific expiry date, but perpetual contracts do not have any expiry date. This means when you do open a position on the perpetual futures contract, it won’t expire until you decide to close the position yourself.

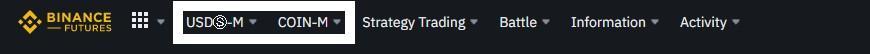

Let’s look at the trading screen again to understand the type of collateral that we can use to open a futures contract. If you are using a stablecoin to open a futures contract, then you will have to select USD-M. However, when you switch to COIN-M, you will be using the base asset for the futures contract as collateral, which in this case would be Bitcoin.

Now, before we dive deeper there’s a crucial point that we must understand about what collateral we use for buying our futures contracts. If you are using a volatile crypto asset as the collateral (such as Bitcoin or Ethereum) then there are chances that your collateral will lose its value in the future due to any sudden market change. If/when that happens, your position will be closed and your assets will be liquidated. Hence, you are advised to use a stablecoin as the base collateral as that will make sure that you are able to retain your position long-term.

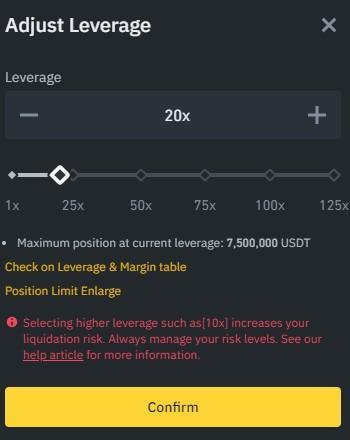

Understanding Leverage in Futures

Leverage helps you take an “x” times position on your assets, which means that if you decide to take leverage of 5x, then you can open a position that is worth $20,000 on a $4,000 collateral. If the market plays in your favor, then you end up making 5x profits. However, if the market is not in your favor then you also stand a chance to lose equal proportions. Whenever you use leverage, remember that both your profits and losses can be greatly amplified depending on the amount of leverage that you take. Binance futures allows you to trade with leverage of up to 125x. However, if you want, you can trade it for as low as 1x, which is equivalent to the value of your collateral.

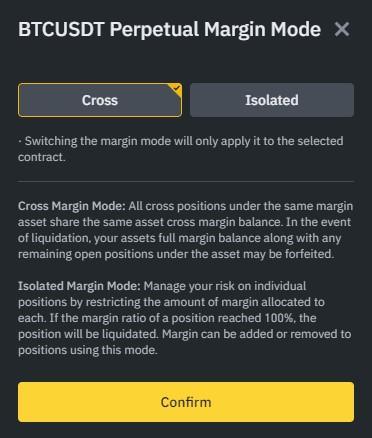

What Are Cross and Isolated Margin Modes in Binance Futures

In Binance futures, you can opt for either cross margin or isolated margin. For the former, your deposited collateral is used to fund positions on all the different futures contracts that you have bought. On the other hand, with the isolated margin mode, your deposited collateral is used to fund specific positions that you open.

Now that we have gone through the initial settings of futures trading on Binance, let’s dive deeper into navigating through the steps involved in actually trading futures on Binance.

Step 2: Trading Futures on Binance.

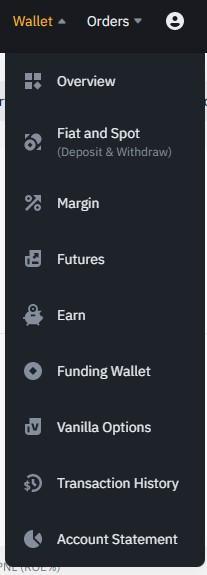

Remember that in order to trade futures on Binance, you will have to first transfer funds from your spot wallet to your futures wallet. You can do that by heading over to your wallet and selecting the “Futures” option.

You will be redirected to a new screen, where you can easily send some capital from your spot account to your futures account.

Once done, you can resume trading on the futures trading screen.

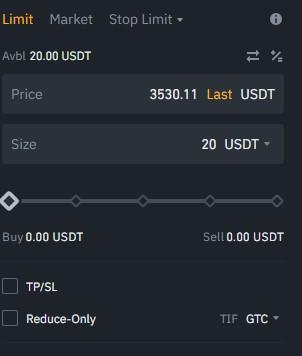

To make this trade easier, I’ll switch to ETH quarterly contract that expires on the 24th

June. Now, I can buy the futures contract for the desired price by putting that in the “Size” tab as below.

You can then buy/long the contract or create a sell/short order. For instance, if you decide to short Ethereum, then you can place a buy order for a price lower than the current price. In this case, you will be able to sell it for, say, $3,500 and then buy back Ethereum for $2,500 (when the market falls). This will mean you are able to realize a $1,500 profit.

While buying the contract, you can decide to limit your order by ticking the “ReduceOnly” box, which effectively means that you cannot go long on any asset beyond the position that you have already opened. This way, you won’t be able to add to your position but you could still sell some of your position to realize some profits. You can also choose the “Stop Market” to open a position subject to the prevailing market price. Thus, if we fix a price with this order, then we will be able to sell our position at that price.

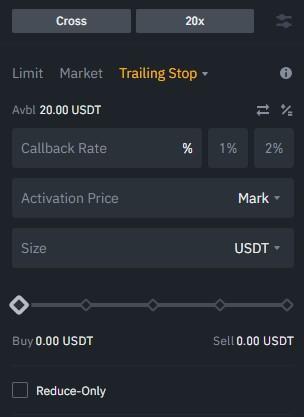

What Is a Trailing Stop Order?

Trailing Stop is another great option for when you want to lock your profits as the price goes up for the contract. It helps you to lock in your profit as the price moves up at a certain “Callback rate”. However, it doesn’t work in the opposite direction, which means that if the price starts falling then your position is effectively closed at the market price.

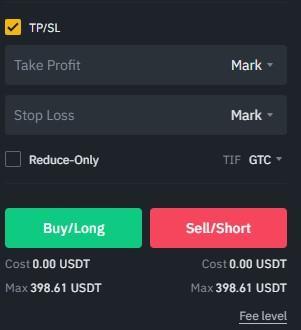

All these orders work well after your position has been opened. However, if you are looking to set the limit at which you take profit and the limit at which you don’t lose, then you can use the “TP/SL” (Take profit/Stop loss) option right here.

Let’s suppose that we got 0.5 ETH at $3000. If we set the “Take Profit” limit at $3500 then our position will be sold and we’ll realize a $500 profit. On the other hand, if the price falls below $3000 to, say, $2500 then our position will be closed as we will set the “Stop Loss” limit at $3500.

Futures trading requires a lot of technical expertise and understanding of the market and also needs you to participate in the market actively. To counteract that, you can switch to the Grid Trading that Binance offers. Here’s how it works.

Step 3: Understanding Binance Futures Grid Trading

Grid trading is a useful feature that Binance offers that can help traders automate the process of trading their futures contracts. As part of this, you are able to set a range within which the exchange places buy and sell orders. You are able to place as many buy and sell orders as you want and realize the profits - within that prespecified price range. Let’s understand how it works.

To access Grid Trading, simply head over to “Strategy Trading” at the top of your trading screen and hover over it. You will see the option for “Futures Grid”.

When you click on it, you will be redirected to a new screen which will look this.

Switch to Manual in the right pane and you will be able to enter a custom price range. When you set a price range (as I have done below), then you are essentially telling the system to buy when the price goes somewhere below the mid of these two extremes, which in this case around $3250. Thus, when the initial price goes below the mid-price then the system will start purchasing the assets. But how many times will it place the buy order? That can be determined by the “Grid”. Let’s say that you put in 10 in that grid. This implies that the system will place 10 buy orders when the price of the asset is in that range.

And when the price starts going beyond the mid-range, then the system will start selling your assets. This will imply that you will be making profits on different orders within that price range.

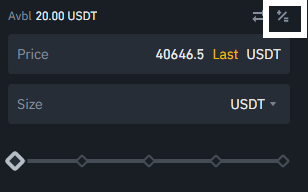

Futures Profit Calcuator

You can calculate your profits on your futures contracts. It is native to Binance and can be used easily. To use it, you will have to specify a range of parameters that the calculator needs to estimate the profits. You can access the calculator by clicking the +/- link as shown in the screenshot below. For more information about how to use the calculator, you can read here.

FAQs

How can I save myself from liquidation while trading futures?

You can create a Stop Limit order on Binance, which will let you control the losses on your position. This is similar to the Stop Limit orders on the spot market. If you decide to keep a spot limit at, say, $4000 for any asset then if its price goes below that, then Binance will simply close your position. This will help you save yourself from losing a lot of capital and/or getting liquidated.

Do I actually buy the coins when placing a futures order?

No, when you buy a futures contract, you are not purchasing the asset itself but buying a derivative of it. Futures is a contract that is based on the underlying asset.

What’s the best way to start trading futures on Binance?

You can use the automated Grid Trading strategy that Binance offers for its futures trading. You can specify the price range between which you want to place your buy/sell orders. This ensures that when the price of the asset falls, the system places buy orders on your behalf and when it rises it places sell orders. This helps automate the process of buying/selling futures without having to actively trade them.

Do I need to take leverage while trading futures?

You can use leverage to maximize your profits while trading futures but you don’t need to. You can even trade for the exact deposit that you have to buy the futures contract.

Binance, however, does offer you to take leverage up to 125x.

What is Funding/Countdown in Binance Futures?

If you are going long on an asset, then you are required to pay certain interest to the short sellers. This interest must be paid every eight hours and is known as funding. This rate is usually 0.01%. Remember to keep this into account whether you are going long or short.

What is leverage while trading futures?

Let’s say you have $5,000 in your account but you are taking 10x leverage. In this case, you can open a position that is worth $50,000. This additional cash is paid in by the broker. If your trade is successful and you are able to make a profit, then it is amplified because of leverage. However, if your trade is unsuccessful, then you stand to lose an equally amplified amount.

Closing Thoughts

Trading futures is risky because of the complexities that it entails. You must understand derivatives to a certain extent before you start trading crypto futures. This is because the traditional knowledge will help you understand how futures trading effectively works and then figure out a winning strategy for yourself. Remember, however, that crypto is a very volatile market. Therefore, while you can make huge profits while trading futures, you can also lose a lot of money.

In addition to this, leverage can end up amplifying both your wins and losses. While Binance does offer upto 125x leverage, remember that you can end up losing an incredible amount of money if you choose to take high leverage, especially if you are just starting to trade futures. You are advised to trade the same amount of capital that you have without any leverage – at least when you are starting trading. You can then decide to take leverage as you gather more experience.